Africa Energy Indaba concluded its 15th instalment in Cape Town, South Africa early this month. The conference aimed to discuss, debate, and identify solutions to enable adequate energy generation across the continent. The Indaba came on the back of a series of challenging energy conditions facing the host country, and its national electricity utility, Eskom. Late on the evening of its first day, President Cyril Ramaphosa announced a new Minister in the Presidency for Electricity, Dr Kgosientsho Ramokgopa.

Members of #StandUpSA and #NotInMyName movement chants slogans during their march to Eskom Megawatt Park, the headquarters of Eskom power utility company in Johannesburg, on February 2, 2023. Photo: Maria Giulia Trombini/AFP

In his 2023 budget speech last month, Finance Minister Enoch Godongwana announced a raft of conditions that would be attached to a Treasury package worth R245 billion to alleviate Eskom’s debt burden of roughly R420 billion. This follows a similar announcement by President Ramaphosa at his 2023 State of the Nation Address (SONA), just prior to the budget speech, that the National Energy Crisis Committee (NECOM) had released its six-month progress update on the implementation of the Energy Action Plan.

The update to the energy crisis action plan announced in July 2022 highlights the steps taken so far by the government, and Eskom, to address the escalating and persistent energy crisis. Since November 2022, the country has experienced load-shedding daily for four consecutive months with this trend set to continue for the foreseeable future. This is partly attributable to a failure to expand fleet capacity and maintain existing infrastructure. It is also attributable to deep-rooted corruption within the utility. These have combined to create an energy supply shortfall which, according to the presidency, is between 4,000 MW and 6,000 MW.

The measures emphasised in the energy crisis action plan have primarily focused on two key objectives: a) improving the performance of Eskom’s existing fleet of power stations; and b) accelerating the procurement of new generation capacity to limit load shedding to lower stages and reduce the risk of such severe load shedding in future. At the 2023 SONA, President Ramaphosa declared a state of national disaster, citing the energy crisis and the need to reduce red tape in order to accelerate the procurement of key projects and maintenance equipment.

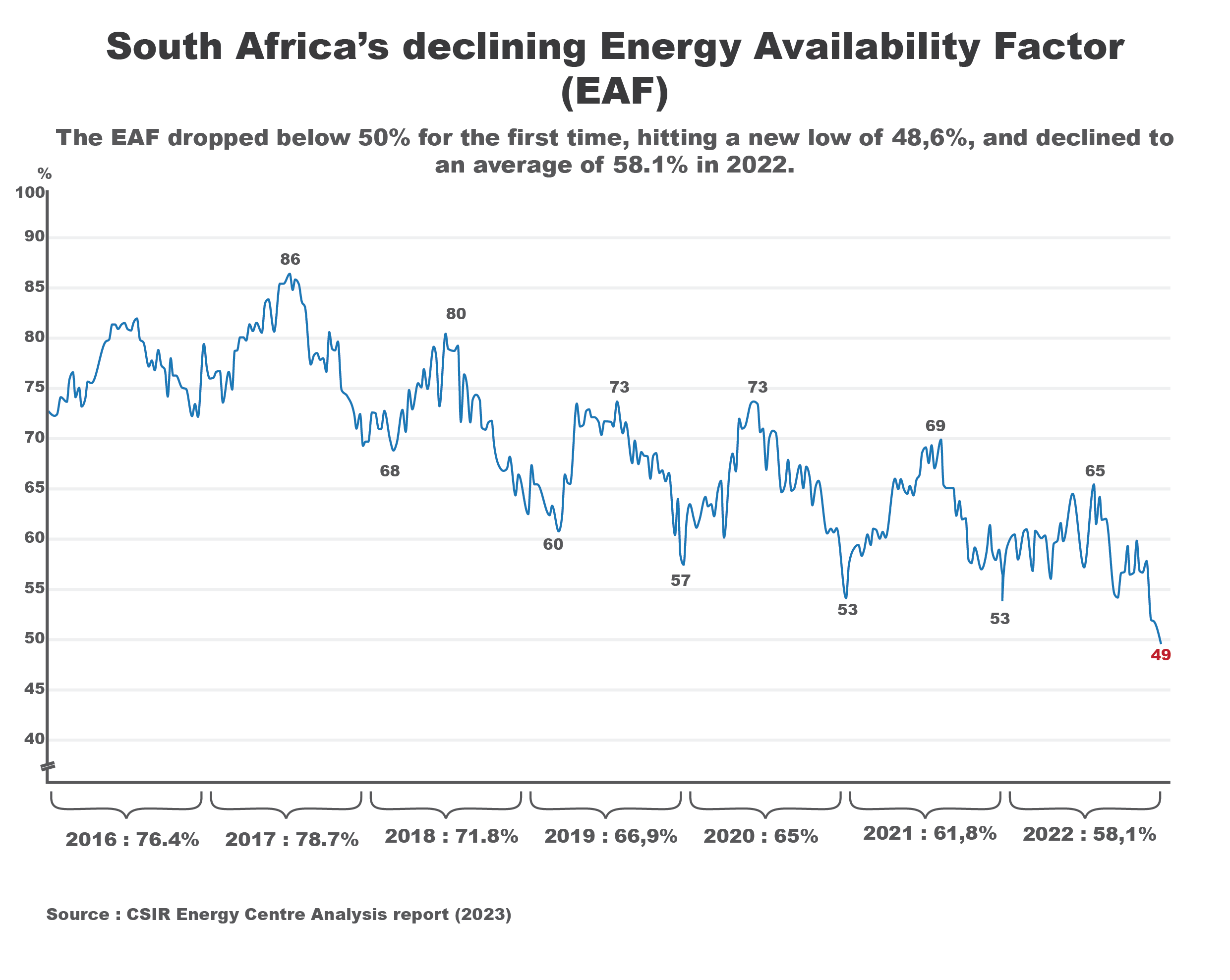

Following the newly elected ANC government’s laudable mass electrification scheme in the 1990s, the demand for South Africa’s generation capacity has long since exceeded its supply. This, coupled with the negligence of critical maintenance and the ineffective construction of the Medupi and Kusile power plants, the country’s energy availability factor (EAF) has significantly declined (Figure 1).

Figure 1. The July Energy Crisis Action Plan is a step in a positive direction but fails to address some pertinent questions.

Improving the performance of Eskom’s existing fleet of power stations

In his address in July 2022, President Cyril Ramaphosa announced a range of measures to specifically address the current underperformance of Eskom’s existing fleet and increase the reliability of its generation capacity. These included: simplifying red tape to make it easier for Eskom to purchase necessary maintenance supplies and equipment timeously for critical maintenance projects; purchasing surplus capacity from existing independent power producers (IPPs) and existing private generators such as mines, paper mills, shopping centres and other private entities; and, finally, importing power from neighbouring countries through the Southern African Power Pool arrangement.

The six-month progress update revealed that of the measures announced, the South African government alongside NECOM and Eskom have established a team of independent experts to diagnose problems at poorly performing power stations and take action to improve plant performance. Outgoing Eskom CEO Andre De Ruyter has drawn attention to systemic corruption at Eskom, interlinked with high levels of theft, sabotage, procurement irregularities and political interference that severely impacts plant performance.

Separately, the progress report notes that Eskom has launched a programme to purchase power from companies with available generation capacity through a standard offer and that the first contracts can be expected to be signed in the coming weeks. Thirdly, it stated that the utility has secured an additional 300 MW through the Southern African Power Pool, and negotiations are underway to secure a potential 1,000 MW from neighbouring countries starting this year. This, if executed timeously, would plug roughly a sixth of the 6,000 MW supply deficit announced by the Presidency earlier this year.

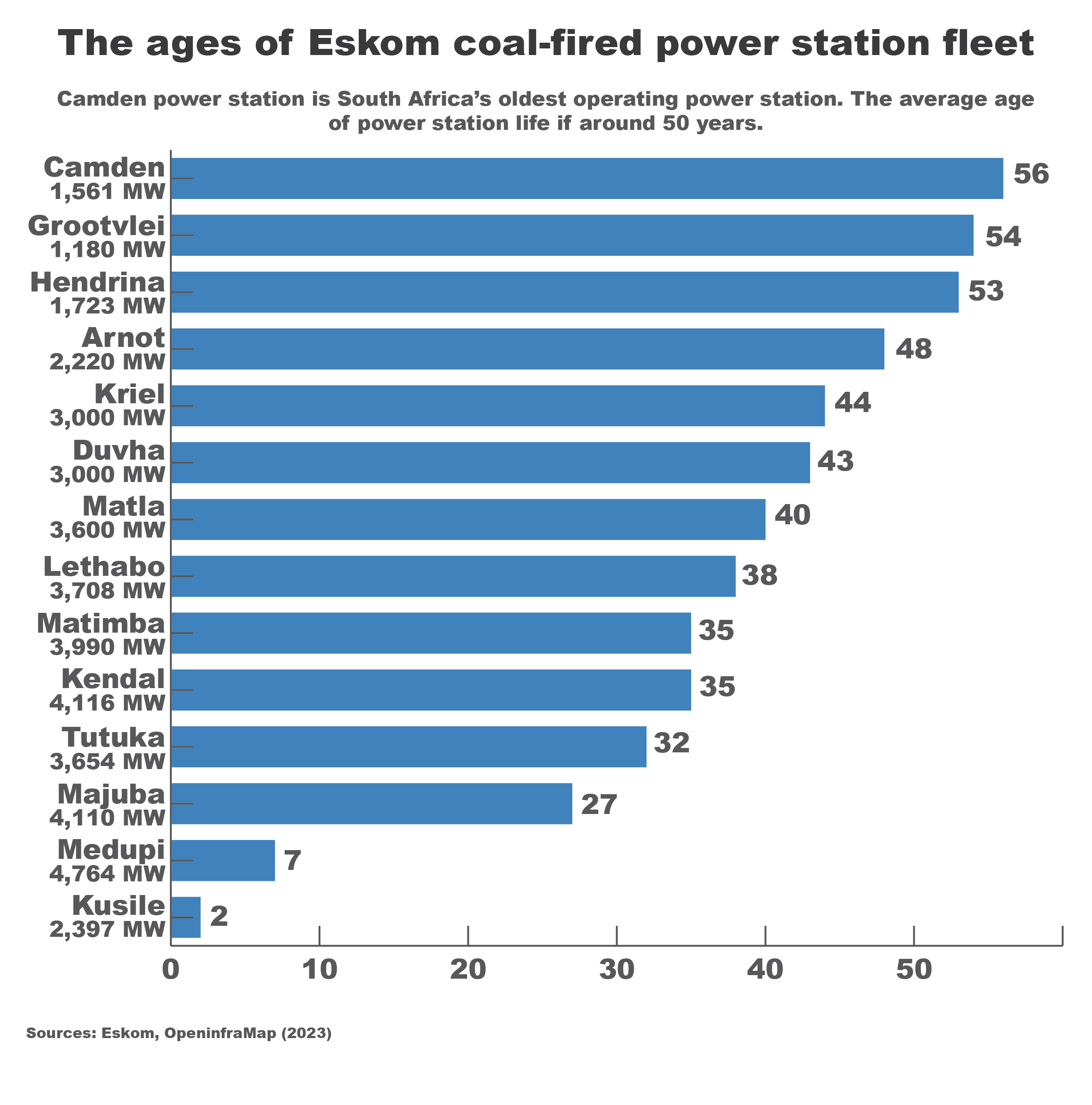

However, progress in Eskom’s fleet performance is evidently “too little new capacity over too much time”. Currently, the average age of Eskom’s power stations, is 40 years, excluding Medupi and Kusile. This is against a global average age of power station retirement of 50 to 60 years – if properly maintained (Figure 2). Therefore, the only viable power stations that can offer long-term reliable generation are Medupi and Kusile, which are expected to be fully completed in 2023 and 2026 respectively.

Essentially, a primary component of the government’s approach to the energy crisis relies too heavily on (and invests in) the restitution of the existing fleet. However, by 2035, 9 of Eskom’s current plants will be nearing end-of-life, which threatens the loss of a further 19,000 MW. By 2050, 12 plants will be offline, creating a potential demand deficit of 33,000MW.

Figure 2: The ages of Eskom’s coal-fired power stations (February, 2023).

Accelerating the procurement of new-generation capacity

Accelerating the procurement of new-generation capacity

A second major focus concerned accelerating the procurement of new generation capacity from various private sector entities as well as renewables, gas and battery projects through the revival of the 2018 Renewable Energy Procurement Programme (REPP) to increase generation capacity and diversify the country’s energy supply.

Since then, the government has announced that schedule 2 of the Electricity Regulation Act has been amended to remove the licensing requirement for generation projects to accelerate private investment. Adjusting this licencing threshold (which had been raised from 1 MW to 100 MW in June 2021) has since resulted in over 100 projects in the pipeline of large-scale private sector projects with an estimated generation capacity of 9,000 MW. The first of these projects is expected to be connected to the grid by the end of 2023.

While this appears to be a move in the right direction, it is likely to adversely affect the licensing process due to the challenges of irregular procurement, severe contract and plant mismanagement and alleged corruption.

Moreover, the 6-month progress update noted that NECOM has streamlined the regulatory process for energy projects and reduced the timeframe for environmental authorisations from 100 days to 57 days to expedite the registration process and ensure projects are approved within 6 months. Of those projects submitted as part of the REPP, 19 project agreements from Bid Window 6 of the renewable energy programme, representing 2,800 MW of new capacity, will soon proceed to construction. This is nearly 4,000 MW short of the overall electricity supply gap that the country is trying to plug. It also falls substantively short of the total capacity that was offered in the bid window.

A large part of the reason for this failure is a critical lack of grid capacity (space available on the national transmission grid for projects to connect to) because of insufficient grid investment and expansion over the past 30 years. Despite the announcement of a new Ministerial determination of 14,771 MW of new generation capacity from wind, solar and battery storage, the outcome of bid window 6 has dwindled expectations of the REPP’s ability to deliver.

Effectively, the outlook of South Africa’s energy crisis remains dismal. While the actions by the government and Eskom seem to imply political will and improved compliance processes, the technical barriers to adding generation capacity still seem insurmountable unless drastic changes are made. The series of unfortunate developments related to procurement irregularities, sabotage, corruption, and theft, indicate that the management and governance frameworks at Eskom are fragile and cast doubt on the country’s ability to implement an energy transition.