As the world went into unprecedented lockdown in February last year, scientists scrambled to determine what the impact of the vastly reduced traffic volumes, industrial activity, and electricity consumption would be on greenhouse gas emissions.

But although COVID-19 drove down the carbon dioxide (CO2) emissions of Africa’s worst polluter – South African power utility Eskom – this will prove temporary. And, as a looming crisis in European power production shows, the much-hailed falling costs of renewables disguises the uncomfortable facts that hidden costs are passed on to consumers, while the need to retain baseload legacy power-generation means coal will remain king in emerging economies like South Africa, the world’s twelfth-worst greenhouse gas emitter, for decades to come.

First to get their Covid-impacted CO2 research peer-reviewed and published was a team at the University of East Anglia in the United Kingdom in May 2020. But they were crippled by a lack of real-time CO2 emissions data. So, they devised a proxy measuring system that combined key indicator data. Africa was not present in their samples, however. Still, the proxy data painted a compelling picture that could be extrapolated to Africa.

South African environmental justice non-profit Humanity NPC commented on the report: “On 7 April 2020, daily carbon dioxide emissions by the 69 countries that account for 97% of all such emissions dropped by 17% over previous years. This was comparable to putting the clock back on air pollution to the year 2006. This meant that Africa’s highest CO2 emitter, South Africa, produced a quarter of a million tons less air pollution each day during the heavy lockdown period of 27 March to 7 April [2020]. The university predicted that even with economies restarting as countries emerge from lockdown, the global average for 2020 would even out at about 7.5% below the previous year’s CO2 pollution level – a decline that matches what the UN’s Intergovernmental Panel on Climate Change (IPCC) stated in 2018 was necessary to maintain every year to keep global warming below 1.5°C.”

The East Anglia researchers warned, however, that previous occasions of significant reductions of daily CO2 emissions had proven ephemeral, “with a post-crisis rebound that restored emissions to their original trajectory” – except during the 1970s and 1980s oil crises, which gave increased impetus to the development of alternative energy sources: “For example, the 2008–2009 global financial crisis saw [a] global CO2 emissions decline of –1.4% in 2009, immediately followed by a growth in emissions of +5.1% in 2010, well above the long-term average. Emissions soon returned to their previous path almost as if the crisis had not occurred.”

So, a truly bold shift towards more sustainable and equitable energy has become critical – and at the UN Convention on Climate Change (COP26) in Glasgow last November, widely seen as the most important since the non-binding 2015 Paris climate accord, 190 countries and bodies committed to stop using coal and shift to greener technologies for power generation and cease building coal-fired power stations. The pact’s deadlines to kill coal are the 2030s for major economies and 2040s for the rest. But steel production – a major coal consumer – was left out of the deal and the world’s major coal polluters like China, India, Brazil, Russia, and South Africa refused to sign.

The 2019 national Integrated Resources Plan (IRP) saw South Africa’s state-owned power utility, Eskom, lay out its “Just Energy Transition” strategy to green-repurpose 14 coal-fired power stations and achieve net zero carbon emissions by 2050, paying attention to employees, affected communities, the environment and reliability of electrical supply. Then in July 2021, the Eskom Research Reference Group – an international coalition of trade unionists, researchers and environmental groups – released a report, Eskom Transformed, that suggested an ideal framework for decarbonising the national energy utility, and the entire economy, in favour of renewables.

Yet it fervently opposed World Bank/International Monetary Fund for-profit models of the privatisation of public energy systems, quoting Eskom’s own 2019 annual report: “It remains a concern that IPP [green independent power producer] purchases were 4% of total generating production, while their cost represented 25% of the total primary energy cost.”

The researchers took the position that Eskom’s “death-spiral” crises of maintenance, supply-generation, and its $29,75 billion debt ($26,51 billion in 2021) were rooted not so much in institutional mismanagement, but rather “within the context of a stagnating and de-industrialising economy, made even worse now by the COVID-19 pandemic”. The backdrop was the gross inequalities of an eroding minerals and energy complex that appeared to have passed its peak – as well as the impositions of climate change on the energy sector, and “the legacy of state capture”, the embezzling of state coffers by ruling party-linked businesses, including via over-inflating the coal price.

Yet, cautioning against the dream of a “painless” transition to renewables, the researchers stressed: “Modern renewable power (mostly wind and solar) is only inching forward as a proportion of energy generated and used. It remains marginal to overall global energy use, which means it has barely affected transport systems, industrial processes, or heating and cooling in buildings.”

Over the past decade, “net wind and solar capacity additions have outstripped net capacity additions for coal and gas”, demand for electricity had soared so high that renewables had stalled and were not replacing, but only complementing fossil fuels, in an environment with “more people without electricity in sub-Saharan Africa than there were in 1990”. Also, because renewables like wind, solar, and surf are weather-dependent, they typically trail fossil fuels in real-time generating capacity, and while coal and gas stations have 40-year lifespans, wind and solar systems only last half that.

In addition, much green power growth had seen public funds used to sponsor private, for-profit power generation. The green lobby uses the “levelled cost of electricity” (installation lifetime costs divided by the value of power produced) in hailing falling renewables prices. But the researchers warn that this represents only 33% of the final cost of electricity, with the remaining two-thirds being hidden, including costs for backup/storage facilities, grid integration, and coal-station decommissioning, plus taxes and levies.

Gwede Mantashe, South African Minister of Minerals and Energy, speaks during the first day of the Mining Indaba in Cape Town, on February 3, 2020. Photo: Rodger Bosch/AFP

These costs of privatised green power were typically passed on to the consumer or to the state (again, the taxpayer) – not to the power producers themselves. Generous state-guaranteed profits for green IPPs under 20-year contracts, regardless of whether their output is used, have contributed significantly to Eskom’s debt burden.

And the falling costs of renewables – driven by better efficiencies, a maturing market, concessionary financing, low interest rates, overinflated initiation costs, and renewables development slowdowns in Europe and China – have caused profits to fall also, driving investment out of the sector. In Europe, by 2018, only about 16% of annual power generation was from renewables – and its supply was wildly variable: an all-time high of 30.1% on 30 July 2017 was followed only three weeks later by a low of 5.5%.

As a result, Europe’s baseload grid is still sustained overwhelmingly by fossil fuels (45.9%) and nuclear (25.5%). Yet energy and environment researcher David Fig told Africa in Fact: “Most progressive analysts now don’t accept the baseload argument because there are ways around it”, with more flexible input systems switching rapidly between “whatever source is most helpful and cheaper at the time”.

But ironically, Europe’s legacy power-generating sector is also experiencing disinvestment due to declining wholesale electricity prices, leading to its own “death-spiral”. European industry body Eurelectric has warned that “the outlook on power system adequacy for the whole of Europe is concerning”. Yet, as the unpredictable variability of renewables makes greater inroads, system stability becomes increasingly fragile, leading to the necessity, the researchers said, of ensuring the survival of the dirty technologies of “zombie utilities” past their natural point of demise.

Eskom CEO André de Ruyter announced to the Presidential Climate Commission on 30 July 2021 a plan – later costed at $33.1 billion – to ask multiple development finance institutions and multilateral banks to fund the utility’s transition of its coal plants to green energy by 2050. Bloomberg reported that this entailed projects producing “1,566.2 megawatts of solar power; 600 megawatts of wind power; 4,000 megawatts of gas-fired power; 61 megawatts of battery storage; 1,400 megawatts from micro-grids [and] 390 megawatts from pumped storage, a type of hydro power”.

But the policy stances of government itself are at cross purposes. Mineral Resources and Energy Minister Gwede Mantashe stated at a mining conference on 7 October 2021 that nuclear power – complementing the current two reactors – was “the saviour for decarbonisation… because renewables have no baseload”. The very same day, at the Sustainable Infrastructure Development Symposium, President Cyril Ramaphosa instead punted the green “hydrogen power-fuels of the future”.

David Fig agreed with the Eskom researchers that it was vital to “get the economics right” by changing the current IPP model, yet still investing in a domestic renewables industry, especially because decarbonisation goals meant “coal won’t support the whole lending cycle” propping Eskom up.

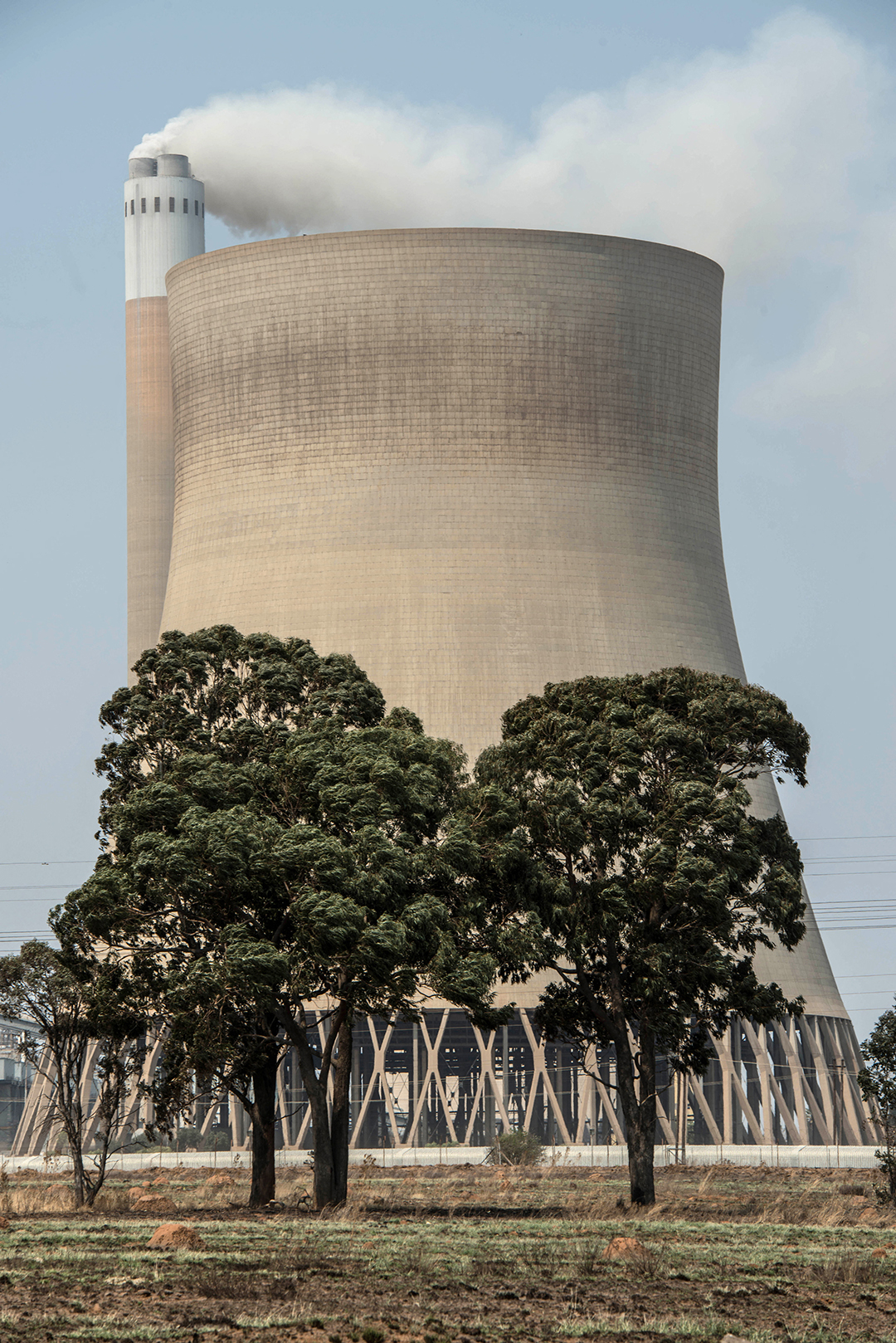

Kendal power station, on the outskirts of Witbank, 28 September 2016. Photo: Mujahid Safodien/AFP

But he argued that nuclear also provided only about 5% of generation in South Africa, was inflexible in matching production to demand, and required high capital subsidies from the state, whereas solar and wind were cheaper and quicker to build, while constantly improving battery technologies reduced renewables’ variability risk.

Confirmed in the 2010 Integrated Resource Plan (IRP), the option to have nuclear generate a quarter of the country’s power needs by 2025 was dogged by policy reversals and a 2017 court ruling setting aside pathfinding agreements with Russia, South Korea, and the United States. A revised plan called for nuclear to come online – under new decarbonisation guidelines – by 2026, with a 2050 target of it contributing 30% of generation, compared to 18% supplied by wind-power, and 6,5% by solar. But in 2018, the government dropped the plan to produce new nuclear capacity – only to revive it in the following year’s IRP.

Still, South Africa announced just prior to last year’s COP26 that it would reduce the upper range of its CO2 emissions target for 2030 by 32% – but this is rated “insufficient” by Berlin-based science and policy institute Climate Analytics. Although South Africa managed to secure a promise of $8,56 billion at COP26 in loans to go green from Britain, Germany, France, and the US, how it aims to achieve even this under-par goal with its deeply troubled “zombie utility” funding overpriced green tech start-ups from the public purse – expenses are escalating and will only peak in 2033 – remains to be seen.

Would you like to gain an understanding of your own impact on the environment? Calculate your own carbon footprint here

Michael Schmidt is a Johannesburg-based investigative journalist who hasworked in 49 countries on six continents. His main focus areas as an Africa correspondent for leading mainstream journals are emerging and high-end technologies, political developments, conflict resolution and transitional justice, and on the continent’s maritime and littoral spaces.